In case you missed the first part about options repair strategies.

Rolling.

As you know options have an end of life: the expiration date.

If you want to maintain your position you need to close (or let expire) your option position and open another option position to the next expiration date.

This is called rolling the position.

Rolling up.

When you close an options position and simultaneously open up a similar position at a higher strike price.

This means higher strike prices for Calls and Puts options.

Rolling forward.

When you close an options position and simultaneously open up a similar position at a later expiry date.

Why rolling the positions :

- The volatility increases and the market moves a little beyond your limits,

- The volatility drops and your option is far out of the money,

- The market crashes and it moves far beyond your limits.

- You have a more defensive approach and you want to adjust :

- your delta,

- the duration of your position (in that case you close the position before expiration. The last days before expiration are increasing the risk).

We have to deal with 4 variables :

- The stock price,

- the time,

- the amount of money involved into the trade (to secure the trade in case of assignment).

- The number of options involved.

The stock price is not under control because the market decides.

What to do if the market goes a little against you.

Let’s suppose you sold a naked Put (cash secured put) you can let the assignment occurs and start selling Call options to sell the stocks at a higher price.

If you do not want to be assigned, you can buy back the option before expiration and sell another one at a lower strike price and at a later expiration date. If it’s well managed you may recover the loss or even enter the trade with a small profit.

When you roll a trade you are adjusting the time and/or the amount of money involved into the trade through the strike price.

What to do when the market crashes or has a huge move.

- You buy back and try to roll but you will suffer a loss. In some cases, a roll forward may help to avoid losses.

- You let the assignment occurs and you also suffer a loss.

- The most appropriate strategy to recover from a market crash is to sell spread. The spread is limiting your loss and you will be able to recover when rolling the trade.

How to roll the position.

Remember the 4 variables : the stock price,the time,the amount of money involved into the trade.The number of options involved.

When rolling forward, you have the opportunity to :

- Lower the strike price (a little),

- Sell the option at a higher price with more extrinsic value.

In that case you can make a profit in terms of money but you are losing time. In case of market crash you will probably have to roll multiple times to be able to deal with a closer strike price. The strike price should join the stock price progressively.

Another way, riskier, is to increase the number of options. This allows you to select a lower strike price. This will probably require more cash to cover the eventual assignment. But you may be able to select a strike price OTM. So you have a good hope that the options expire worthless.

I will not recommend this method because more cash is locked and the risk is increasing.

Examples.

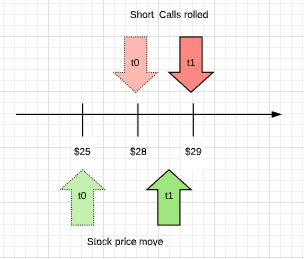

Covered Call.

You bought the stock XYZ at $25 (t0). You sell an option Call with a strike price $28 for $0.60.

Before the expiration date the stock rallies to $28.50 (t1).

The option price is $1.20.

You can buy the option and suffer a $0.60 loss but the loss is compensated by the rise in the share.

You are able to sell another Call option at a higher strike price $29 (t1).

Secured cash Put.

The stock XYZ price is $33.

You sell a Put option (Stock XYZ) strike price $28 for $1.75 with an expiration date in 6 months.

After 3 months the market drops and the stock price is $24.50. Your potential loss is $2.50.

You decide to roll the option to a further expiration date, let’s say 6 more months.

This allows you to sell the option at a strike price of $25 for $1.70.

You suffer a small loss $0.05 on the option price but you have reduced the strike price by $3.

If the stock rise before the expiration date your option will expire worthless.

If the stock drops again, you will have to roll the option one more time.

This article was the last article of the option series. My purpose was to popularize options. It has been a nice experience. I hope you could discover the fascinating world of options.

The last article, yes, there is another article. At the opposite this one will be more oriented. I will explain how I am trading options.

Options Academy articles

I. Let’s talk about options.

II. 4 basic strategies.

III. Advanced strategies.

IV. Ultimate strategies.

V. When volatility, time & statistics meet.

VI. Option management strategies (Part I).

VII. Option management strategies (Part II).

VIII. How I am trading options.

Sources

- The Options Guide,

- tastytrade.com,

- Investopedia,

- The Motley Fool,

- John Hull « Options futures and other derivatives ».

Soyez le premier à commenter