Options repair strategy : when options save stocks.

The main principle in the stock repair strategy is to move the break even near the stock price after it drops.

In those case you need to implement a strategy called ratio spread.

This strategy may help you to recover from the loss as the price rises.

Let’s have an example, suppose you bought the stock at $40 after few times the stock drops to $30.

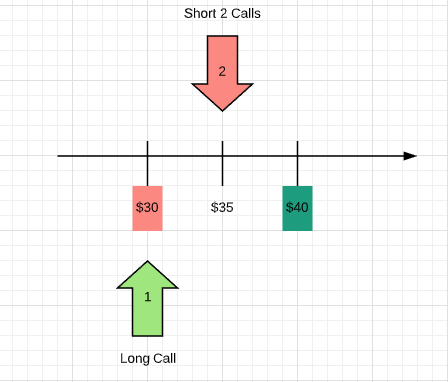

You can enter the following ratio spread :

- Buy 1 Call $30 for $2

- Sell 2 Calls $35 for $1

This means you can recover initiating a zero cost trade (except fees).

When the stock rises to $35, you will be assigned :

- Your long Call bring you the following profit ($35-$30)x100=$500

- Your long position will be assigned and you suffer a loss of ($40-$35)x100 = $500.

The profit realized with the options offset the loss realized on the shares. All positions are closed and you can reassess your trading situation.

Options Academy articles

I. Let’s talk about options.

II. 4 basic strategies.

III. Advanced strategies.

IV. Ultimate strategies.

V. When volatility, time & statistics meet.

VI. Option management strategies (Part I).

VII. Option management strategies (Part II).

VIII. How I am trading options.

Sources

- The Options Guide,

- tastytrade.com,

- Investopedia,

- The Motley Fool,

- John Hull « Options futures and other derivatives ».

Soyez le premier à commenter