Table des matières

If you missed it, here is the first part « Let’s talk about options »

Let us go for some practice. To make things easier I will use the same strike price, the same price paid or the same premium. I will also suppose there are no commissions paid and theses cases are related to European style options.

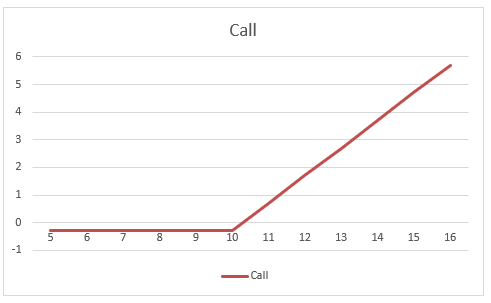

Buying an option Call.

Suppose the stock of AAA company is trading at 10€. A Call option contract with a strike price of 10€ expiring in a month’s time is being priced at 0.03€. You strongly believe that AAA stock will rise sharply in the coming weeks. So you paid 3€ to purchase a single $10 AAA Call option covering 100 shares.

At expiration, let’s suppose the stock rallies to 12€.

Your profit will be (Current Stock price – Strike price) x100 – premium paid.

Profit : (12€ – 10€) x 100 – 3€ = 197€.

The breakeven is (Strike price + premium paid) = 10€ + 0.03€ = 10.03€.

Lessons learned :

- Your max profit is unlimited.

- Your max loss is limited to the premium paid.

- The breakeven is the sum of the strike price and the premium paid.

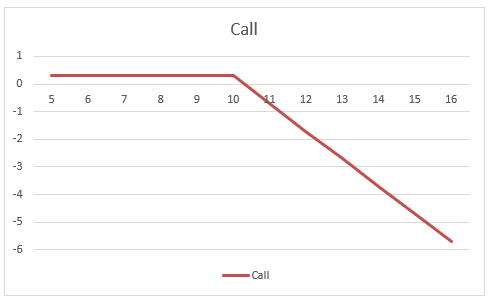

Selling an option Call.

Suppose the stock of AAA company is trading at 9€. A Call option contract with a strike price of 10€ expiring in a month’s time is being priced at 0.03€. You strongly believe that AAA stock will drop sharply in the coming weeks. So you sell an option Call 10€ and you receive a 3€ premium. This example suppose you do not own 100 AAA shares.

At expiration if the AAA stock price is under 10€ the 3€ premium received is your maximum profit.

If the stock rally until 13€ you will have to buy the stocks at 13€.

Your loss is (13€ x 100) – 3€ = 1297€.

The breakeven is (Strike price + premium paid) = 10€ + 0.03€ = 10.03€.

Lessons learned :

- Your max profit is premium received (3€).

- Your loss is potentially unlimited.

- The breakeven is the sum of the strike price and the premium received.

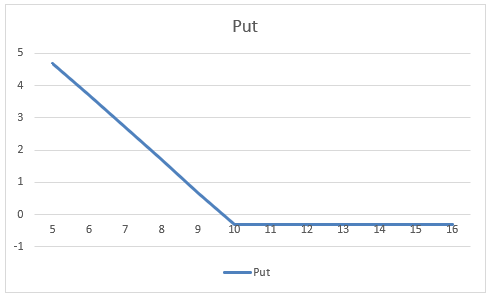

Buying an option Put.

Suppose the stock of AAA company is trading at 10€. A Put option contract with a strike price of 10€ expiring in a month’s time is being priced at 0.03€. You strongly believe that AAA stock will drop sharply in the coming weeks. So you paid 3€ to sell a single $10 AAA Put option covering 100 shares.

At expiration, let’s suppose the stock drops to 8€.

Your profit will be (Current Stock price – Strike price) x100 – premium paid.

Profit : (10€ – 8€) x 100 – 3€ = 197€.

If the stock price is 10€ or higher your max loss is equal to the premium paid (3€).

The breakeven is the strike price minus the premium paid: 9.97€.

Lessons learned :

- Your max profit is limited to the strike price minus the premium paid.

- Your max loss is limited to the premium paid.

- The breakeven is (Strike price – premium paid).

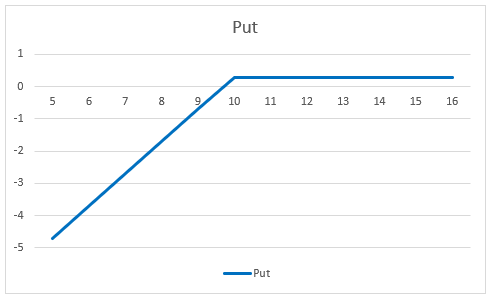

Selling an option Put.

Suppose the stock of AAA company is trading at 11€. You believe that AAA stock will continue to rise in the coming weeks. A Put option contract with a strike price of 10€ expiring in a month’s time is being priced at 0.03€. So you decide to sell an option Put with a strike price 10€ and you receive a 3€ premium.

At expiration, let’s suppose the stock price is 12€.

Your profit will be the premium received.

If the stock price is 8€ your loss is equal to (Strike price – Stock price) x 100 + premium received.

Loss : (8€ – 10€) x 100 + 3€ = -197€.

The breakeven is Strike price – premium received: 10€ – 0.03€ = 9.97€

Lessons learned :

- Your max profit is limited to the premium received.

- Your max loss is potentially unlimited.

- The breakeven is the difference between the strike price and the premium received.

Options Academy articles

I. Let’s talk about options.

II. 4 basic strategies.

III. Advanced strategies.

IV. Ultimate strategies.

V. When volatility, time & statistics meet.

VI. Option management strategies (Part I).

VII. Option management strategies (Part II).

VIII. How I am trading options.

Sources

- The Options Guide,

- tastytrade.com,

- Investopedia,

- The Motley Fool,

- John Hull « Options futures and other derivatives ».

Soyez le premier à commenter