Table des matières

In case you missed it, here is my previous post about the advanced strategies.

Last step to the Option Strategy Kingdom.

You know how one leg and two legs strategies work, let me conclude by presenting you 4 legs strategies.

I will illustrate how to set the same strategies in two different ways.

Let’s go back to the straddle and the strangle and let’s see how we can improve them.

- In case of short straddle / strangle, we are going to limiting the possible loss by buying options.

- In case of long straddle / strangle, we are going to reduce the cost of the trade while selling options.

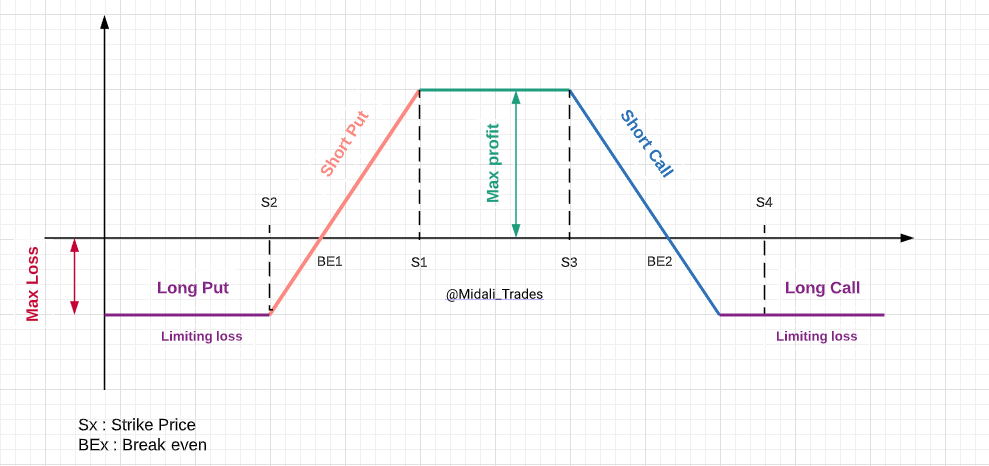

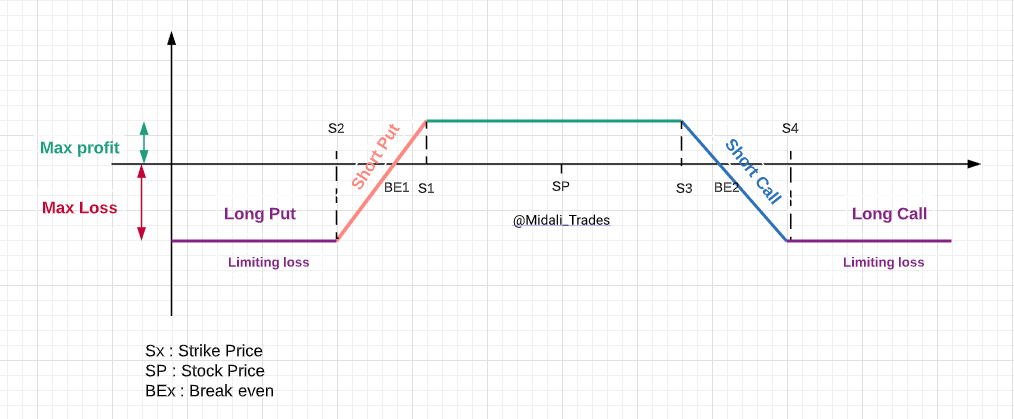

Before describing the strategies let me show you what I call the anatomy of the 4 legs strategy (condor).

The most important things to remember are :

- The short options have an unlimited potential loss. (We will see later that this is not entirely true).

- The most important thing in trading is to control the risk which is the potential loss.

- The only way is to cut the potential loss by buying a Put or a Call.

Iron Butterfly Spread.

This strategy is based on a Put spread and a Call spread. This is an improved short straddle.

The Iron Butterfly spread is a limited risk, limited profit trading strategy. You can set the Iron Butterfly Spread when you think the stock will not move a lot until the expiration date. In other words when you think the volatility will stay low.

Construction.

- Buy 1 OTM Put

- Sell 1 ATM Put

- Sell 1 ATM Call

- Buy 1 OTM Call

You get the maximum profit for the iron butterfly when the underlying stock price at expiration is equal to the strike price at which the call and put options are sold.

At this price, all the options expire worthless and the premium received when entering the trade are your profits.

The formula for calculating maximum profit is:

Max Profit = Net Premium Received – Commissions Paid

Max Profit Achieved When Price of Underlying = Strike Price of Short Call/Put

Maximum loss for the iron butterfly strategy is also limited and occurs when:

Price of Underlying >= Strike Price of Long Call

OR

Price of Underlying <= Strike Price of Long Put

The maximum loss is equal to the difference in strike between the calls (or puts) minus the net credit received to enter the trade.

The formula for calculating maximum loss is:

Max Loss = Strike Price of Long Call – Strike Price of Short Call – Net Premium Received + Commissions Paid

There 2 break evens points are:

- Upper Break even Point = Strike Price of Short Call + Net Premium Received,

- Lower Break even Point = Strike Price of Short Put – Net Premium Received.

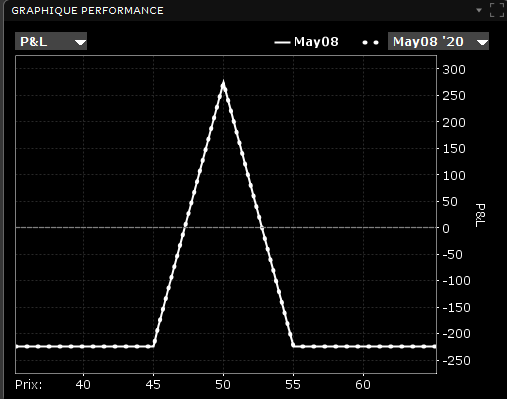

Example.

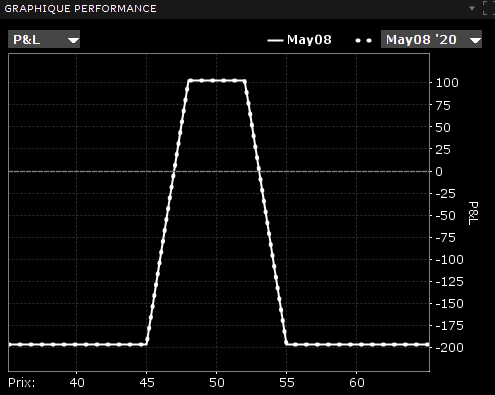

The stock AMD price is $50.39, you decide to enter the following Iron Butterfly: AMD May08 45/50 50/55.

- Buy Put 45 $0.33

- Sell Put 50 $1.52

- Sell Call 50 $1.90

- Buy Call 55 $0.32

You can enter the trade for a net credit which is also your max profit :

Max profit : (-$0.33 + $1.52 + $1.90 – $0.32) x 100= $277

Max Loss : ($45 – $50) x 100 + $277 = -$223.

or ($50 – $55) x 100 + $277 = -$223.

Butterfly Spread.

This strategy uses only one type of option Call or Put.

Construction.

- Buy 1 ITM Call

- Sell 2 ATM Calls

- Buy 1 OTM Call

Maximum profit for the long butterfly spread is reached when the underlying stock price remains unchanged at expiration.

At this price, only the lower striking call expires in the money.

The formula for calculating maximum profit is:

Max Profit = Strike Price of Short Call – Strike Price of Lower Strike Long Call – Net Premium Paid

The maximum loss for the long butterfly spread is the sum of the premium paid to enter the trade (plus commissions).

The formula for calculating maximum loss is:

Max Loss = Net Premium Paid + Commissions Paid

Max Loss Occurs When :

- Price of Underlying <= Strike Price of Lower Strike Long Call,

- Price of Underlying >= Strike Price of Higher Strike Long Call.

The 2 break evens points are :

- Upper Breakeven Point = Strike Price of Higher Strike Long Call – Net Premium Paid

- Lower Breakeven Point = Strike Price of Lower Strike Long Call + Net Premium Paid

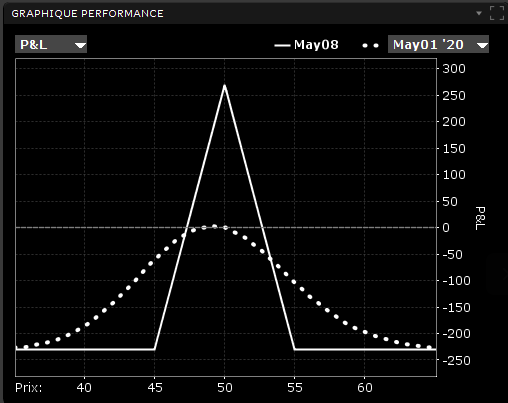

Example.

The stock AMD price is $50.39, you decide to enter the following Butterfly: AMD May08 45/50/55.

- Buy Call 45 $5.70

- Sell 2 Call 50 $1.90

- Buy Call 55 $0.32

You can enter the trade for a net debit which is also your max loss :

Max loss : (-$5.70 + (2 x $1.90) – $0.32) x 100= -$222

Max profit : ($50 – $45) x 100 – $222 = $278.

Iron Condor.

Construction.

- Sell 1 OTM Put

- Buy 1 OTM Put (Lower Strike)

- Sell 1 OTM Call

- Buy 1 OTM Call (Higher Strike)

Maximum gain for the iron condor strategy is equal to the net credit received when entering the trade.

Maximum profit is reached when the underlying stock price is between the strikes of the call and put sold at expiration.

At this price, all the options expire worthless.

The formula for calculating maximum profit is:

Max Profit = Net Premium Received – Commissions Paid

Maximum loss for the iron condor spread is also limited but significantly higher than the maximum profit.

Max Loss Occurs When:

Price of Underlying >= Strike Price of Long Call

OR

Price of Underlying <= Strike Price of Long Put

The formula for calculating maximum loss is:

Max Loss = Strike Price of Long Call – Strike Price of Short Call – Net Premium Received + Commissions Paid

The 2 breakevens are :

- Upper Breakeven Point = Strike Price of Short Call + Net Premium Received

- Lower Breakeven Point = Strike Price of Short Put – Net Premium Received

Example.

The stock AMD price is $50.39, you decide to enter the following Iron Condor: AMD May08 45/48 52/55

- Buy Put 45 $0.30

- Sell Put 48 $0.77

- Sell Call 52 $1.0.

- Buy Call 55 $0.33

You can enter the trade for a net credit which is also your max profit :

Max profit : (-$0.30 + $0.77 + $1.00 – $0.33) x 100= $114

Max Loss : ($45 – $48) x 100 + $114 = -$186.

or ($52 – $55) x 100 + $114 = -$186.

Condor.

Contruction.

- Sell 1 ITM Call

- Buy 1 ITM Call (Lower Strike)

- Sell 1 OTM Call

- Buy 1 OTM Call (Higher Strike)

Maximum profit for the long condor option strategy is achieved when the stock price stays between the 2 middle strikes at expiration.

The maximum profit is equal to the difference in strike prices of the 2 lower striking calls less the initial debit taken to enter the trade.

The formula for calculating maximum profit is:

Max Profit = Strike Price of Lower Strike Short Call – Strike Price of Lower Strike Long Call – Net Premium Paid – Commissions Paid

Max Profit Achieved When Price of Underlying is in between the Strike Prices of the 2 Short Calls

The maximum possible loss for a long condor option strategy is equal to the initial debit taken when entering the trade.

Max loss occurs when:

Price of Underlying <= Strike Price of Lower Strike Long Call

OR

Price of Underlying >= Strike Price of Higher Strike Long Call

The maximum loss is:

Max Loss = Net Premium Paid + Commissions Paid

The 2 breakevens are:

- Upper Breakeven Point = Strike Price of Highest Strike Long Call – Net Premium Received

- Lower Breakeven Point = Strike Price of Lowest Strike Long Call + Net Premium Received

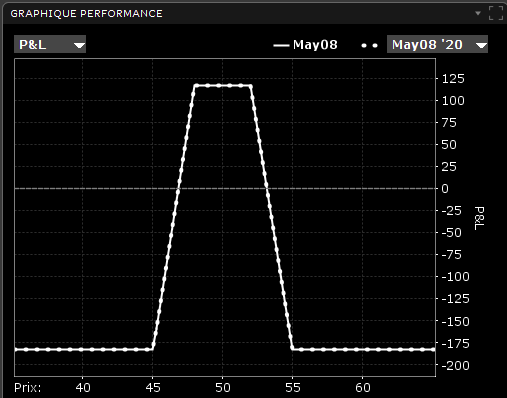

Example.

The stock AMD price is $50.39, you decide to enter the following Condor: AMD May08 45/48/52/55

- Buy call 45 $5.80

- Sell call 48 $3.20

- Sell Call 52 $1.0

- Buy Call 55 $0.33

You can enter the trade for a net debit which is also your max loss :

Max loss : (-$5.80 + $3.20 +1.0 – $0.33) x 100= -$193

Max profit : ($48 – $45) x 100 – $193 = $107

or ($55 – $52) x 100 – $193 = $107

Conclusions.

I would like to remind you these cases are set with real values but are for educational purpose. I will never set these trades because the risk is too high.

A real trade should look more like this :

- A bigger distance between the stock price (SP) and the strike prices (S1, S3) which lead to a smaller profit (but a higher probability of profit).

- The max loss may be higher than the max profit.

- The strategy is based on 2 spreads, in the worst case the stock price will go outside of one of the break evens. This means :

- The other side will expire worthless.

- You may want to adjust the losing side using a loss recovery strategy (we will discuss in following chapters).

- In 4 legs strategies the fees may have an important impact on the profitability of the trade. The fees should always be a checkpoint before validate the trade.

There are many more strategies than those presented here. The limit is at the level of the trader’s imagination. My goal is not to make a collection, there are specialized sites which do it better than me. I particularly recommend the options guide site, which taught me everything.

Options Academy articles

I. Let’s talk about options.

II. 4 basic strategies.

III. Advanced strategies.

IV. Ultimate strategies.

V. When volatility, time & statistics meet.

VI. Option management strategies (Part I).

VII. Option management strategies (Part II).

VIII. How I am trading options.

Sources

- The Options Guide,

- tastytrade.com,

- Investopedia,

- The Motley Fool,

- John Hull « Options futures and other derivatives ».

Soyez le premier à commenter