Table des matières

In case you missed it, here is my previous post about 4 basic strategies.

Let’s go a little bit further.

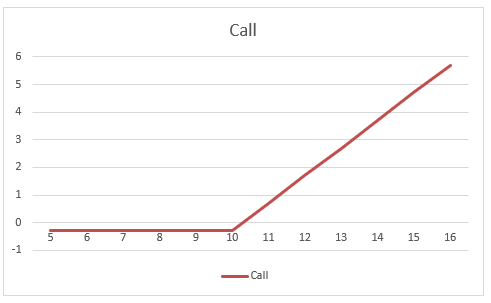

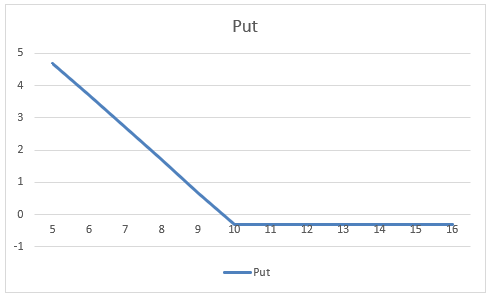

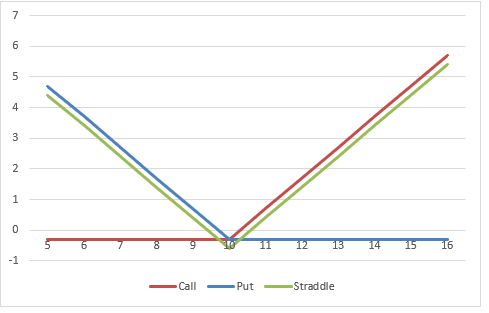

In the previous section only one option was involved in the strategy. Each different option is also called a leg. We are going to add another leg and notice what we can do. The magic of options is being able to combine several of these strategies into one trade. We also add another dimension: the time (expiration date). What makes option trading so exciting is the endless possibility of combinations available to us. These strategies are represented by a Call option (red line) and a Put option (blue line). The combination of the two options is represented by the green line.

Straddle.

Long straddle.

Suppose the stock of AAA company is trading at 10€. You suspect a big move but you do not know if the stock price will rise or drop sharply.

You decide to buy a Call and a Put option with the same strike price (10€).

Let’s say both option price is 0.03€ so you pay 6€.

+

=

At expiration, let’s suppose the stock price is 12€.

Your profit is ( Stock price – Strike price) x 100 – (Put premium + Call premium). Which is (12€ – 10€) x 100 – (3€ + 3€) = 194€.

If the stock price is 9€ your profit is (Strike price – Stock price) x 100 – (Put premium + Call premium). Which is (10€ – 9€) x 100 – (3€ + 3€) = 94€.

If the stock price did not move and stayed at 10€, you suffer your max loss equals to the premiums paid : (3€ + 3€) = 6€.

The breakevens are Strike price ± Sum of premium paid: 10€ ± 0.06€.

Breakeven1: 9.94€

Breakeven2: 10.06€

Lessons learned :

- Your max profit is potentially unlimited.

- Your max loss is the sum of the premiums paid.

- The breakevens are Strike price ± Sum of premium paid.

When to use it :

- You think the price will move strongly but you don’t know which direction. For example after the earnings announcement. You can buy the straddle a few weeks before the earnings.

- The volatility is (very) low, you anticipate a big change. This allows you to buy the straddle at a low price and sell it when volatility has increased.

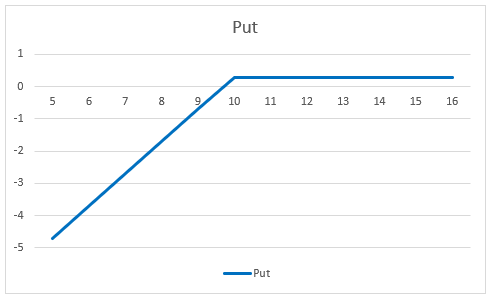

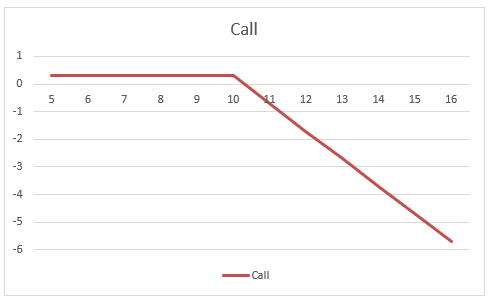

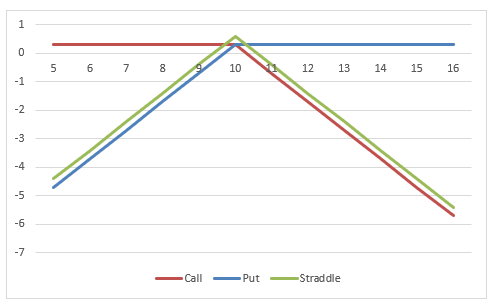

Short straddle.

Suppose the stock of AAA company is trading at 10€. You suspect it will not move significantly in the following weeks.

You decide to sell Call and a Put option with the same strike price (10€).

Let’s say both option price is 0.03€ so you receive a 6€ premium.

+

=

At expiration, let’s suppose the stock price is 10€.

Your profit is equal to the premium received (6€).

If the stock price is 9€ the Call option expired worthless. You are assigned and you have to buy the shares at 9€.

Your loss is (Strike price – Stock price) x 100 – (Put premium + Call premium). Which is (9€ – 10€) x 100 + (3€ + 3€) = -94€.

If the stock price is 12€ the Put option expired worthless. You are assigned and you have to sell the shares at 12€.

Your loss is (Stock price – Strike price) x 100 + (Put premium + Call premium). Which is (10€ – 12€) x 100 + (3€ + 3€) = -194€.

The breakevens are Strike price ± Sum of premium paid: 10€ ± 0.06€.

BreakEven1: 9.94€

BreakEven2: 10.06€

Lessons learned :

- Your max profit is limited.

- Your max loss is potentially unlimited.

- The breakevens are Strike price ± Sum of premium received

When to use it :

- You think the price will not move significantly. You can sell the straddle a few weeks before the expiration.

- The volatility is very high and you expect a slowdown. This allows you to buy back the straddle at a lower price or you can let it expire.

Strangle.

The principle is the same for strangles as for straddles. We just have to deal with two different strike prices. One strike price for the Call option and one strike price for the Put option.

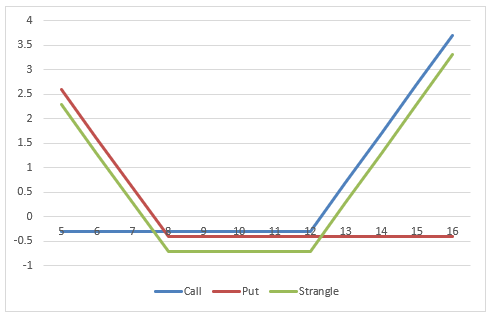

Long strangle.

Suppose the stock of AAA company is trading at 10€. You suspect a big move but you do not know if the stock price will rise or drop sharply.

You decide to buy a Call strike price 12€ for 0.03€ and a Put option with the strike price 8€ for 0.04€. You have to pay 7€ which is also your maximum possible loss.

At expiration, let’s suppose the stock price is 14€.

Your profit is ( Stock price – Call Strike price) x 100 – (Put premium + Call premium). Which is (14€ – 12€) x 100 – (3€ + 4€) = 193€.

The option Put expires worthless.

If the stock price is 7€ your profit is (Put Strike price – Stock price) x 100 – (Put premium + Call premium). Which is (9€ – 8€) x 100 – (3€ + 4€) = 93€. The Call option expires worthless.

If the stock price did not move and stayed between the strike price (8€ and 12€), you suffer your max loss equals to the premiums paid : (3€ + 4€) = 7€. Both options expire worthless.

The breakevens are :

- Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid. (12€+0.07€)=12.07€

- Lower Breakeven Point = Strike Price of Long Put – Net Premium Paid. (8€-0.07€)=7.93€

Lessons learned :

- Your max profit is potentially unlimited.

- Your max loss is the sum of the premiums paid.

- The max loss occurs when the stock price is in between the strike price of long Call and strike price of long Put.

When to use it :

- You think the price will move strongly but you don’t know which direction. For example after the earnings announcement. You can buy the strangle a few weeks before the earnings.

- The volatility is (very) low, you anticipate a big change. This allows you to buy the strangle at a low price and sell it when volatility has increased.

- To be profitable, the strangle needs bigger moves than the straddle because of the 2 strike prices. This makes strangles cheaper than straddles.

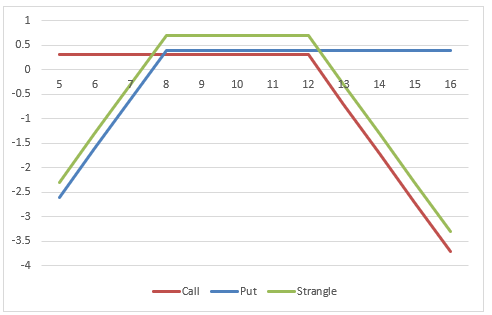

Short strangle.

Suppose the stock of AAA company is trading at 10€. You suspect it will not move significantly in the following weeks.

You decide to sell a Call strike price 12€ for 0.03€ and a Put option with the strike price 8€ for 0.04€.

You receive 7€ premium which is also your maximum possible profit.

At expiration, let’s suppose the stock price is 10€.

Your profit is the sum of the premiums received which is (3€ + 4€) = 7€.

Your loss is potentially unlimited if the price has a big move outside one of the strike price.

The breakevens are :

- Upper Breakeven Point = Strike Price of Long Call + Net Premium. (12€+0.07€)=12.07€

- Lower Breakeven Point = Strike Price of Long Put – Net Premium. (8€-0.07€)=7.93€

Lessons learned :

- Your max loss is potentially unlimited.

- Your max profit is the sum of the premiums received.

- The max loss occurs when the stock price is in between the strike price of long Call and strike price of long Put.

When to use it :

- You think the underlying price will not move strongly until expiration.

- The volatility should lower, you anticipate a change. This allows you to sell the strangle at a higher price and buy it when volatility has dropped.

Spreads.

Introduction.

A spread consists of buying (or selling) one option at a certain strike price and selling (or buying) another at a more distant strike price.

There are three types of spreads :

- Vertical spread: different strike price, same expiration date.

- Horizontal spread: same strike price, different expiration date. Also called Calendar spread.

- Diagonal spread: different strike prices, different expiration dates.

By trading spreads you have no surprise, the max profit & the max loss are known in advance.

I created the previous cases and graphs myself for educational purposes. the next examples will be more realistic because I will design them with my trading tool and they will be based on real cases.

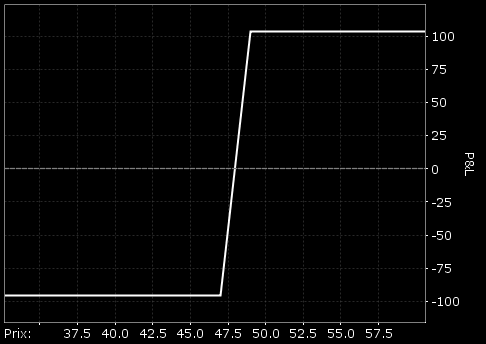

Long Call Spread (also called Bull Call Spread).

You can set this strategy when you expect the underlying to rise a little.

Construction.

- Buy 1 ITM Call.

- Sell 1 OTM Call.

- Same underlying and same expiration date.

Example.

The stock KO price is $46.89, you think the stock is going to rise in the coming weeks.

You decide to buy the following spread :

- Buying a Call strike price $47 @ $1.20

- Selling a Call Strike price $49@ $0.24

To buy the spread strategy you will have to pay $96 ($120-$24).

The break-even is between the two strike prices at $47.96.

The max profit is $104 ($4900-$4700+$96 fees, not incl.).

The max loss is $96 corresponding to the premium paid (fees not incl.).

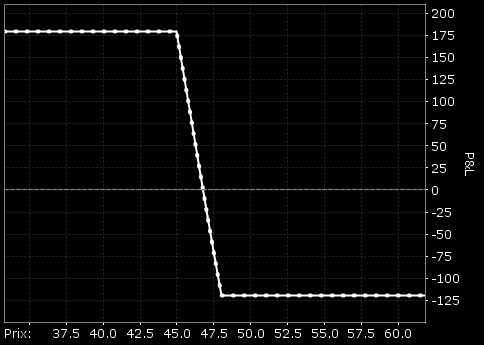

Short Put Spread (also called Bear Put Spread).

You can set this strategy when you expect the underlying to drop a little.

Construction.

- Sell 1 ITM Put.

- Buy 1 OTM Put.

- Same underlying and same expiration date.

Example.

The stock AMD price is $47.55, you think the stock is going to drop soon.

You decide to buy the following spread :

- Buying a Put strike price $48 @ $2.26

- Selling a Put Strike price $45 @ $1.06

To buy the spread strategy you will have to pay $120 ($226-$106).

The break even is between the two strike prices at $46.80.

The max profit is $180 ($4800-$4500-$120 fees not incl.).

The max loss is $120 corresponding to the premium paid (fees not incl.).

Calendar Spread.

Construction.

- Sell 1 Near-Term OTM Call (or Put).

- Buy 1 Long-Term OTM Call (or Put).

- Same strike price.

Example.

The stock AMD price is $57, you think the stock will not move a lot during the next weeks. Using this strategy you are able to benefit from the rapid time decay of the near term option.

You decide to buy the following spread :

- Selling a May Put strike price $55 @ $2.50

- Buying a Jun Put Strike price $55 @ $4.83

The spread calendar you cost you $233 ($483-$250).

The maximum possible loss for the calendar spread is limited to the initial debit taken to Put on the spread. It occurs when the stock price goes down (Call)/ up (Put) and stays down/up until the expiration of the longer-term options.

Follow-up action near the expiration term.

Like all calendar strategies, it is necessary to decide on which follow-up action to take when the near-term options expire. This decision depends heavily on the revised outlook of the underlying stock at that time.

- If you think that the underlying volatility will remain low, then you may wish to enter another calendar spread by writing another near term Call.

- If you think that the volatility is likely to increase/drop significantly, you may wish to hold on to the long term Call/Put to profit from any large upward price movement that may occur.

- However, if you are unsure of what to expect of the underlying, it may be best to take profit (or loss) and move on to evaluate other trading possibilities.

Options Academy articles

I. Let’s talk about options.

II. 4 basic strategies.

III. Advanced strategies.

IV. Ultimate strategies.

V. When volatility, time & statistics meet.

VI. Option management strategies (Part I).

VII. Option management strategies (Part II).

VIII. How I am trading options.

Sources

- The Options Guide,

- tastytrade.com,

- Investopedia,

- The Motley Fool,

- John Hull « Options futures and other derivatives ».

Soyez le premier à commenter