Table des matières

Finally, here we are, after spending so many times and energy writing about options. The time has come to tell you how I am trading options.

I am mainly an option writer, I am going to describe to you why I am selling options and how I am selling them.

Why am I an option writer?

We know options have an expiration date. Due to this expiration date, the option value is :

Option Price = Intrinsic value + Extrinsic value.

Extrinsic value is a function of the volatility and the number of days to expiration (DTE). This is the extrinsic value an option writer is trying to catch.

When we sell an OTM option, the option price is :

Option Price = Extrinsic value.

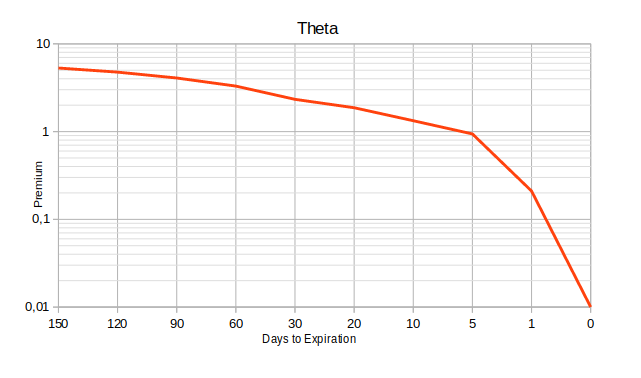

Remember the following graph showing the loss of extrinsic values as time goes by. The expiration date is most of the time the nearest expiration which about 35-50 days to expiration.

Some portfolio managers need to hedge their portfolio. They are usually buying options. To do so, they are ready to pay the option premium. I am a kind of insurance seller for these portfolios managers.

My rules as option writer.

- Selling Put options against stocks/ETFs I am willing to own in my portfolio, even if adding the stocks into the portfolio is not the purpose.

- Owning the capital to cover the assignment. It is called cash-secured Put. It is a fundamental risk management rule. The market may drop and you could be assigned on all your option lines.

- Never sell options against indexes. There is no underlying, so nothing can be added into the portfolio for a long time which may lead to heavy losses. ETF indexes are not included in that restriction rule.

- Select stocks with sufficient liquidity of options.

- Writing options with about 40-50 days to expiration.

- Rolling options when DTE is between 15 – 20 or when we reached 50% profit. This ensures sufficient liquidity, reduces risk by keeping an illiquid and almost worthless option in the portfolio.

- Adding implied volatility (IV) filter :

- Stocks : IV > 45%,

- ETF : IV > 25%.

- Trading with at least 70% of the probability of profit.

- Never sell options on multiple expiration dates. I mean consecutive expiration dates. I prefer dealing with multiple contracts on one expiration date than one contract on several expiration dates. If the stock goes on the wrong side you will have multiple trades to deal with, which is not a comfortable situation.

- Trading small but trading often.

- Defining a minimum amount premium level.

My strategy as option seller.

Stock selection.

In my opinion, selecting stocks for option trading is very similar to select stocks to invest in. Since I have the risk to be assigned, I prefer being assign with stocks I am willing to have (or I have) in portfolio.

To join the list the stocks need to have strong financial figures. I could not accept to be assigned with « junk » stocks even i they allow me to collect more premiums.

The choosing the strike price.

Remember statistics.

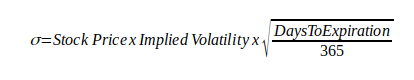

The implied volatility is assimilated to 1 standard deviation. We can adjust the value according to the number of days to expiration.

Technical analysis.

The distance between the stock price and the strike price of the short Put/Call is the risk you are willing to take.

Support & Resistance levels may be good friends. They may help you to set a nearer limit than the statistical approach. The stock rebound on the resistance and continue to rise. You can set the limit below the resistance level and benefit from a higher premium without taking many more risks.

Here are the option strategies I am usually trading.

I usually trade these option strategies :

- Short Put (for more informations see basic strategies),

- Short Put spread (for more informations see advanced strategies),

- Ratio credit spread (Put / Call),

- Covered Call,

- Condor (for more informations see ultimate strategies).

- Jade Lizard (Thanks TastyTrade : more information)

Assignment or rolling the position?

Managing the trade about 20 days to expiration or at 50% profit reduces the risk to be assigned, but that does not avoid it completely (US-Style).

But this does not answer the question.

Why do I let the assignment occurs?

When I notice a nice swing trading opportunity. The stock is near a support level and I expect the stock is about to rebound. That way I can benefit from the rebound and sell OTM covered calls.

When I am rolling the position?

The position turned in the money and i do not want to be assigned. The only way is to close the trade by buying back the options sold. At that point I need to evaluate if :

- I can roll the option at a lower strike price or/and at a further date,

- I have to wait because the market conditions are not favorable.

Thank you !

This article is the last one of the option series. These pages will be enriched over time. Options are an endless topic.

I hope you enjoyed reading this set of articles.

~ The End ~

Options Academy articles

I. Let’s talk about options.

II. 4 basic strategies.

III. Advanced strategies.

IV. Ultimate strategies.

V. When volatility, time & statistics meet.

VI. Option management strategies (Part I).

VII. Option management strategies (Part II).

VIII. How I am trading options.

Sources

- The Options Guide,

- tastytrade.com,

- Investopedia,

- The Motley Fool,

- John Hull « Options futures and other derivatives ».

Soyez le premier à commenter