First, I wish you a Happy New Year & a lot of success in your trading.

My activity is mainly ruled by the option’s expiration date, so to make things easier to me, I decided to publish my monthly update according to this calendar (from the 3rd Friday of one month to the next 3rd Friday).

Options trading is the most active topic, so I decided to move it at the first place.

Options.

Let’s start the new year with new goals. I learned a lot last year, and I am reaching the target year after year, so I decided to raise the target level.

This is the reason why you will notice two target amounts.

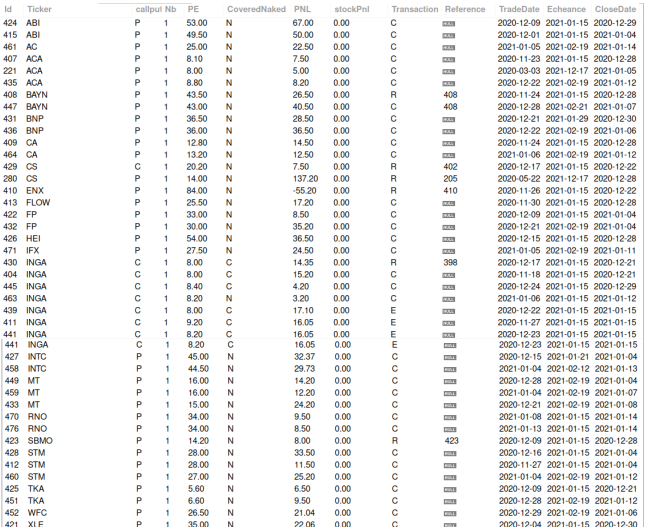

Transaction : [A] Assigned, [E] Expired, [C] Closed, [R] Rolled.

This month ends with a nice profit of 1027.45€.

| Current month € | 1027.45 | ||

| YTD Total € | 1027.45 | ||

| Target 1 & 2 € | 2600,00 | 3200,00 | |

| Achieved | 39,51 % | 32,10 % | |

Projected incomes from rolled options.

Powered by TSBA.mobi GoogleGraph Wordpress plugin

YTD options incomes 1027€ (target 3200€).

If you are interested to have a look at my full option statistics, please have a look at my option income page.

Updated target prices.

You will find my current European Stocks Option List.

Portfolio.

Stocks.

No change in the stock portfolio for the last month.

I did not receive any dividends.

ETF.

Last month there was no change in the ETF portfolio except I received the following dividends. I received these dividends after December 22nd, i the reason why I am taking them into account for this period.

- IUSA: 5.77€,

- SPYD: 16.41€.

- TRET: 15.04€

| YTD Total € | 37,22 | |

| Target € | 228,00 | |

| Achieved | 16,33 % |

Portfolio.

| Ticker | Cost Basis | Price | Weigth | P/L | Cur. Weight | Div Yield | ||||

| SPYD | 47,4 | 50,09 | 16,29 % | 5,37 % | 16,47 % | 1,92 % | ||||

| SPYW | 21,81 | 21,55 | 10,50 % | -1,21 % | 9,92 % | 2,94 % | ||||

| TRET | 42,71 | 33,79 | 20,55 % | -26,40 % | 15,55 % | 2,72 % | ||||

| VECP | 54,57 | 54,97 | 11,26 % | 0,73 % | 10,84 % | 0,48 % | ||||

| VUCP | 49,62 | 47,99 | 8,53 % | -3,40 % | 7,89 % | 2,41 % | ||||

| CW8 | 274,6 | 340,39 | 9,44 % | 19,33 % | 11,19 % | 0,00 % | ||||

| IUSA | 27,34 | 31,19 | 11,28 % | 12,34 % | 12,31 % | 1,11 % | ||||

| OD7F | 2,78 | 3,88 | 7,65 % | 28,35 % | 10,21 % | 0,00 % | ||||

| PINR | 13,12 | 17,11 | 4,51 % | 23,32 % | 5,63 % | 0,00 % | ||||

| Total | 100% | 4,56 % | 100% | |||||||

| Last updated : 14/01/2021 | ||||||||||

The dividend yield correspond to the dividends collected in 2020.

Dividend matrix for 2020.

| 2020 | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

| CW8 | 0 | ||||||||||||

| PINR | 0 | ||||||||||||

| SPYD EUDI | 14,71 | 14,37 | 16,41 | 45,49 | |||||||||

| SPYW USDV | 3,34 | 41,55 | 44,89 | ||||||||||

| TRET | 13,74 | 17,94 | 34,71 | 15,04 | 81,43 | ||||||||

| VECP | 0,48 | 0,32 | 0,38 | 0,60 | 1,26 | 1,22 | 0,87 | 1,04 | 0,86 | 0,81 | 7,84 | ||

| VUCP | 4,13 | 2,81 | 8,44 | 3,90 | 2,40 | 3,19 | 2,73 | 2,25 | 29,85 | ||||

| IUSA | 6,49 | 6,03 | 5,77 | 18,29 | |||||||||

| Sub-total | 0 | 0,48 | 32,11 | 4,51 | 3,41 | 34,13 | 0 | 5,12 | 99,93 | 4,23 | 3,59 | 40,28 | |

| Total € | 227,79 | ||||||||||||

Swing trading.

No new swing position initiated during the last month.

The existing positions are :

- The first one, SBMO bought at 10.76€ & 11.75€, due to the nice fundamental figures. This stock has joined my buy list for portfolio and also for option trading. The current price is 15.70€.

- The second one, EURN entry at 9.48€, is also a nice opportunity according to the fundamental and technical analysis. The current price is 7.04€.

Stay Home and be careful on the markets.

For more information about my way to generate income using options strategies, you can read my option academy page.

Stay tuned !

Disclaimer.

The naked strategy (selling Call or Put) is aggressive and higher risk. This may lead to huge losses. Be aware of what you do. I wrote articles about options trading. These publications are NOT trading or investment advice.

Soyez le premier à commenter