My activity is mainly ruled by the options expiration date, so to make things easier to me, I decided to publish my monthly update according to this calendar (from the 3rd Friday of one month to the next 3rd Friday).

Portfolio.

Stocks.

Due to the Atenor capital increase, I had the opportunity to buy 5 new shares at 56€.

This month I received some dividend from CS: 110.37€.

This lead to a YTD total of 1651.16€ which is 62 % of the expected annual target.

The target amount is 2650€, this will probably not achieved due to the corona crisis.

ETF.

This month there were no change in the ETF portfolio except i received some dividends.

- IUSA : 6.49 €,

- TRET: 17.94 €,

- VECP: 0.57 €,

- VUCP: 2.17 €.

The total dividend amount for the year is 74.60€.

It is my first year investing in ETF, so I did not set any target for the year. I was invested for years in multiple funds I decided to sell to set an ETF portfolio.

Swing trading.

No new swing position initiated during the last month.

The existing position are :

- The first one, SBMO bought at 10.76€ & 11.75€, due to the nice fundamental figures. This stock has joined my buy list for portfolio and also for option trading. The current price is 13.53€.

- The second one, EURN entry at 9.48€, is also a nice opportunity according to the fundamental and technical analysis. The current price is 8.14€.

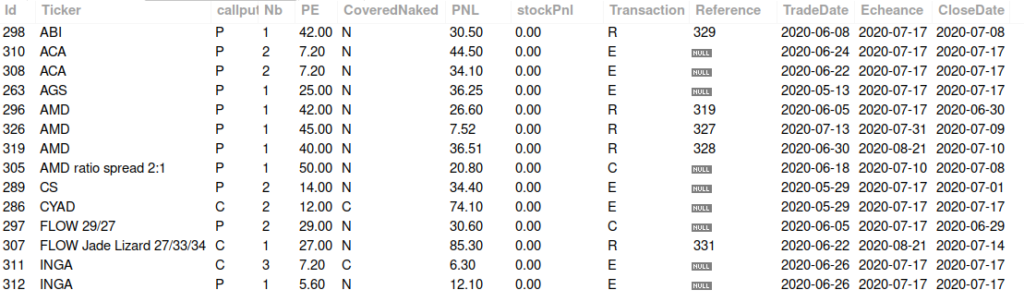

Options.

Transaction : [A] Assigned, [E] Expired, [C] Closed, [R] Rolled.

This month ends with a nice profit of 479.58€. This amount i very good because it is upper my last year average. This year the volatility rate helps a lot. I also adapted my management rules :

- Closing or rolling position after 50 % profit,

- Rolling position around 20 DTE.

The target income for the year is 2400 €.

Due to the rolled positions, the YTD incomes are negatives –2140.32€.

The rolled positions amount is around 3988.63€. This is still in line with the target profit for the year.

Projected incomes from rolled options.

Powered by TSBA.mobi GoogleGraph Wordpress plugin

Updated target prices.

I should be able to provide the target price for next month.

Stay Home and be careful on the markets.

For more information about my way to generate income using options strategies, you can read my option academy page.

Stay tuned !

Disclaimer.

The naked strategy (selling Call or Put) is aggressive and higher risk. This may lead to huge losses. Be aware of what you do. I wrote articles about options trading. These publications are NOT trading or investment advice.

Soyez le premier à commenter