My activity is mainly ruled by the options expiration date, so to make things easier to me, I decided to publish my monthly update according to this calendar (from the 3rd Friday of one month to the next 3rd Friday).

Portfolio.

Stocks.

This month I bought a stock, SBMO, on a swing opportunity. It’s also a good opportunity according to fundamental analysis.

This month the dividend season started !!!!.

- ATEB : 32.34€,

- FLOW: 55€ (from assigned option),

- MERY : 96€,

- WEB : 165.25€

This lead to a YTD total of 446.59€ which is 16 % of the expected annual target.

The target amount is 2650€, this will probably not achieved due to corona crisis.

ETF.

I decided to buy some new ETF :

- IUSA : S&P500 ETF distributing dividend, I bought at 26.56€ & 26.94€

- OD7F : I wanted to invest slowly in the WTI oil. The price WTI oil price should very slowly returns to normal prices. It is a very small position.

I bought at 2.43€ & 2.71 €. I may buy some more if the market goes in the right direction.

I received the following dividends :

- VECP: 0.60€,

- VUCP: 2.81€, (converted from $ to €).

The total dividend amount for the year is 40.47€.

It is my first year investing in ETF, so I did not set any target for the year. I was invested for years in multiple funds I decided to sell to set an ETF portfolio.

Swing trading.

This is a new section, I am very bad in swing trading, but some talks with a friend may have change something in my mind. So I started buying 2 stocks.

- The first one, SBMO, due to the nice fundamental figures. This stock has joined my buy list for portfolio and also for option trading.

- The second one, EURN, is also a nice opportunity according to the fundamental and technical analysis.

Options.

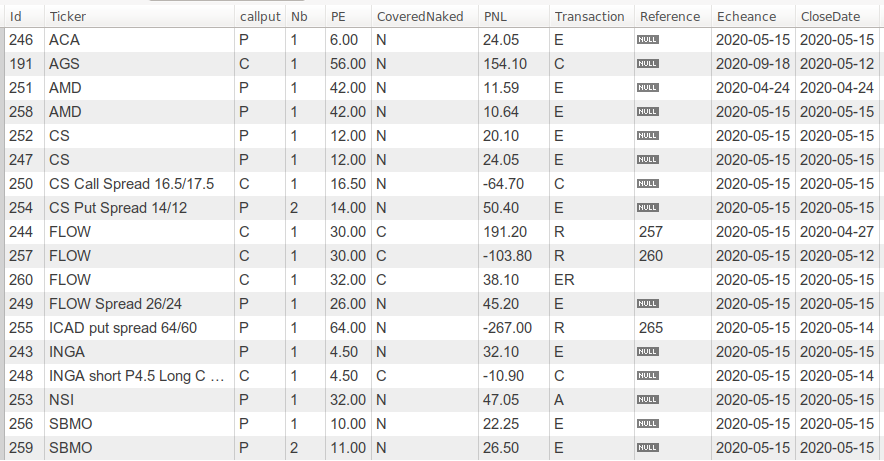

Transaction : [A] Assigned, [E] Expired, [C] Closed, [R] Rolled.

This month ends with a profit of 250.93 €. This is inline with my usual profits.

The target income for the year is 2400 €.

Due to the rolled positions the YTD incomes are negatives -15.86 €.

The rolled positions amount is 1633.55€. This is still inline with the target profit for the year.

I had to roll the ICAD spread to another expiration date with a profit.

I also had 2 surprises, Flow had been rolled multiple times and should be assigned at 32€. Finally, I was not assigned because the price drops few cents under the limit at expiration…time ! I contacted the broker to be sure it was not an error ! 🙂 So I’m going to roll again at 32€ which is the target price of analysts.

The second surprise was to be assigned on NSI for the same reason !

Updated target prices.

I should be able to provide the target price for July.

Stay Home and be careful on the markets.

For more information about my way to generate income using options strategies, you can read my option academy page.

Stay tuned !

Disclaimer.

The naked strategy (selling Call or Put) is aggressive and higher risk. This may lead to huge losses. Be aware of what you do. I wrote articles about options trading. These publications are NOT trading or investment advice.

Soyez le premier à commenter