My activity is mainly ruled by the options expiration date, so to make things easier to me, I decided to publish my monthly update according to this calendar (from the 3rd Friday of one month to the next 3rd Friday).

Portfolio.

Stocks.

No change in the stock portfolio for the last month.

I received the following dividends :

- EURN : 7.59€,

- WEB : 185.08€,

- BEFB : 78.79€.

So the YTD total is 3224.81€ which is 121 % of the expected annual target.

The target amount is 2650€, I am really happy to reach the target because a lot of companies announced they will not pay any dividend due to the Corona crisis. Fortunately, most companies were able to pay their dividends.

ETF.

Last month there was no change in the ETF portfolio except I received the following dividends.

- VECP: 0.81 €,

- VUCP: 2.25 €.

The total dividend amount for the year is 190.53€.

It is my first year investing in ETF, so I did not set any target for the year. I was invested for years in multiple funds I decided to sell to set an ETF portfolio.

Swing trading.

No new swing position initiated during the last month.

The existing positions are :

- The first one, SBMO bought at 10.76€ & 11.75€, due to the nice fundamental figures. This stock has joined my buy list for portfolio and also for option trading. The current price is 15.44€.

- The second one, EURN entry at 9.48€, is also a nice opportunity according to the fundamental and technical analysis. The current price is 6.65€.

Options.

This year has been special. The corona crisis, lots of doubts, and a lot of volatility on the markets.

Fortunately, it was not my first year of options trading. I had to manage a few losing trades.

With less experience, I could have given up on options trading. You will understand better having an eye on the year to date graph below.

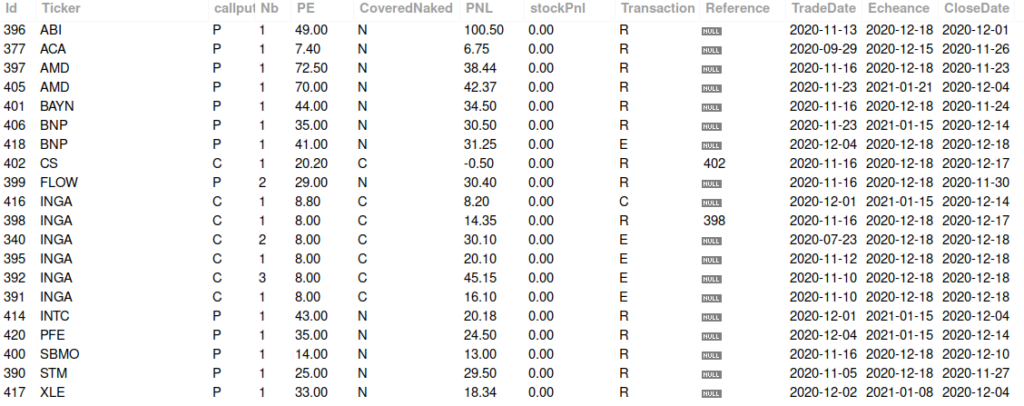

Transaction : [A] Assigned, [E] Expired, [C] Closed, [R] Rolled.

This month ends with a nice profit of 553.73€.

The target income for the year is 2400€.

The YTD incomes are beating all the expectations: 3229.56€.

The rolled positions amount is around 848.15€ and will be taken into account in 2021.

This year has been really exciting because I had to manage a lot of losing trades, and I was not sure to reach the annual goals.

I also learned a lot and these new skills allowed me to add more settings to my trading engine.

I am really excited to start in 2021, I hope to become more profitable.

At the most difficult moment of the year, I decided I could trade more next year if I am able to reach the annual target.

Projected incomes from rolled options.

Powered by TSBA.mobi GoogleGraph Wordpress plugin

YTD options incomes 3229.56€ (target 2400€).

Powered by TSBA.mobi GoogleGraph Wordpress plugin

Stay tuned, I am preparing a 2020 recap article containing some statistics, lessons learned and goals for 2021.

But before that, I wish you a wonderful holiday season. Have a good rest and stay safe !

If you are interested to have a look at my full option statistics, please have a look at my option income page.

Updated target prices.

I should be able to provide the target price for the end of the month.

Stay Home and be careful on the markets.

For more information about my way to generate income using options strategies, you can read my option academy page.

Stay tuned !

Disclaimer.

The naked strategy (selling Call or Put) is aggressive and higher risk. This may lead to huge losses. Be aware of what you do. I wrote articles about options trading. These publications are NOT trading or investment advice.

Soyez le premier à commenter