My activity is mainly ruled by the options expiration date, so to make things easier to me, I decided to publish my monthly update according to this calendar (from the 3rd Friday of one month to the next 3rd Friday).

Portfolio.

This month I made some changes in the portfolio :

- Mercialys (MERY): I took a small profit at 7.17€,

- Shurgard (SHUR): first position at 28.23€,

- Warehouse Estate Belgium (W.E.B): I added some more at 51.09€,

- Xior: I added some more at 39.77€

There seems to be a lot and maybe too early but I have decided to add stocks in my portfolio in 3 waves allowing each time a third of the budget. I think I’ve been a little bit too quickly for the 2 first waves, so I will be very patient for the last one.

I did not receive any dividend yet, the Belgian dividend season is coming. Due to the coronavirus lots of companies will cut or reduce dividends so rendez-vous next month for more information.

ETF.

- CW8: sold some at 267.02€,

- TRET: swing trading buy/sell at 30.33€ / 32.17€ ,

- VECP: bought some at 50.56€

I received the following dividends :

- SPYD: 14.71€,

- PYW: 3.34€,

- TRET: 13.74€

The total dividend amount for the year is 32.59€.

It is my first year investing in ETF so I did not set any target for the year. I was invested for years in multiple funds I decided to sell to set an ETF portfolio.

Options.

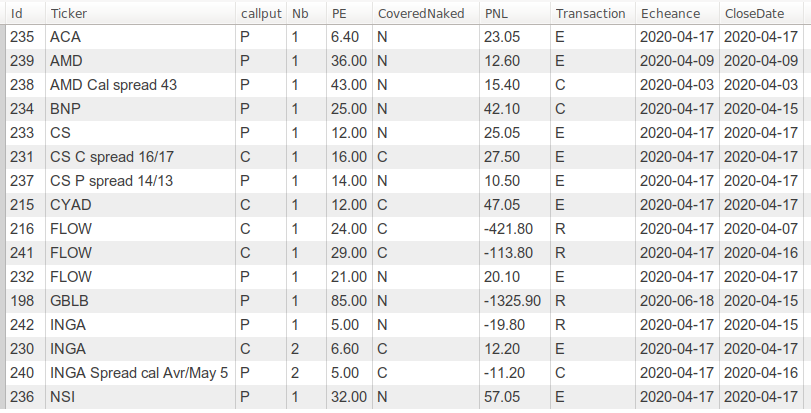

Transaction : [A] Assigned, [E] Expired, [C] Closed, [R] Rolled.

This month ends with a huge loss of 1599.90 EUR.

This is due to my way of accounting the trades, I had to choose between two dates: expiration date and trade closing date. I have decided to take into account the trade closing date.

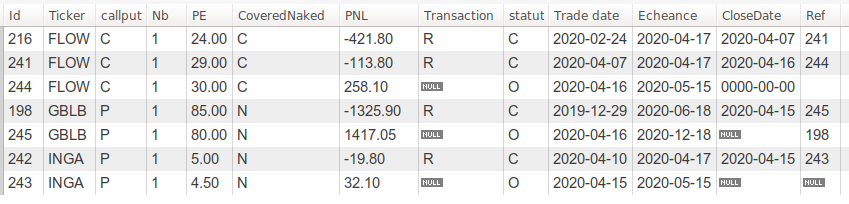

You probably noticed every negative figures are related to rolled positions except one. Let me explain these cases in detail.

Flow, I was assigned @ 23.50€ a few months ago, so I decided to sell a call @ 24€. But the stock had a huge move and raised until 29€ and 30.50€. So I decided to buy back my 24€ Call and Sell another 29€ Call the price is covered by stock price difference 500€ (29€-24€). After I decide to do the same once more and I bought back my 29€ Call to sell another 30€ call for a net premium of 258.10€. At that level of price, I won’t raise my target and I will let the assignment.

GBLB, this option was bought last year after I was assigned @ 90€. So a target of 85€ sounded good to me. But the crisis came and the stock had a huge drop. This is the reason why we should sell options near the expiration date. In this case, I managed the position by buying back the option put for 1325€ and selling another one for 1417€ with a lower strike price and a later expiration date. This let me more time to be right.

Finally, INGA, with no surprise I did the same and lowered the strike price level while receiving more premiums.

If we do not take into account these rolled positions that will be taken into account in the next months, my profits for the month are 260.30€. This is in line with my monthly target.

Let’s come back to my early closing trade last month. I had the following risk reversal strategy FLOW 18/22 (expiration December 2020). I decided to close the trade due to market conditions. Now I know to stock raised until 30€ … and I had a call at 22€ !!! For sure I am a (little) disappointed but the market was plunging. I have no regrets! I will do the same in such conditions.

The target income for the year is 2400 €.

Due to the rolled positions the YTD incomes are negatives @ -266.90€.

Last month YTD incomes were 1333€, without taking into account my rolled positions, it will be around 1593€ which represents 66% of the entire year target.

Updated target prices.

I am not able to set new targets in the current market move. I could stay away until the knives have finished falling.

Stay Home and be careful on the markets.

For more information about my way to generate income using options strategies, you can read my option academy page.

Stay tuned !

Disclaimer.

The naked strategy (selling Call or Put) is aggressive and higher risk. This may lead to huge losses. Be aware of what you do. I wrote articles about options trading. These publications are NOT trading or investment advice.

Soyez le premier à commenter